TransRisk Features

|

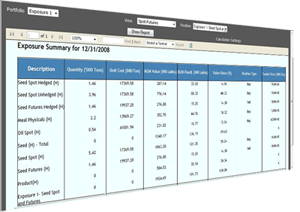

Exposure Analysis : Customized net exposure engine to calculate net exposure based on your business process. | ||||||

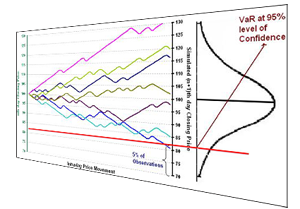

| Risk Measurement : Measure Risk based on Value at Risk (VaR) Framework using Monte-Carlo Simulation, Historical Simulation or Parametric (Variance Covariance) methodologies. | |||||||

| Risk Analysis : Decompose risk to drill-down into position-wise risk and analyze it from multiple dimensions. | |||||||

| Risk Simulation :Simulate various risk calculation and exposure parameters to generate Stress-testing and what-if scenarios. |

|

||||||

|

Reports and Graphical Analysis : Highly flexible reporting framework and OLAP (OnLine Analytical Processing) tool allows you to prepare any report and save the format for future use. | ||||||

| Strategy Cockpit : Bird’s eye-view of the most useful reports for senior management. | |||||||

| Configurability : Configure custom settings for risk calculation and import / create own price series. | |||||||

| Alerts and Limits :Define internal limits exposures, P&Ls and Risks on traders, commodities, trading desks, positions, markets, etc. and get system generated alerts on limit breaches. |

|

||||||

| Utility of VaR : Use TransGraph’s Innovative “Imputed Risk Model” for applying VaR numbers to assess the true health of the portfolio. | |||||||

Technology

|

|||||||

Explore more...

- TransRisk

Challenges | Workflow - Key Features

New Version - Why TransRisk

Solution Benefits - Request TransRisk Demo

- FAQs

- Resources Center

Brochures | Case Studies | Conference Papers - Schedule a Meeting

Testimonials

“ I am writing to extend my thanks for the research and price forecasting services provided to us on a daily basis by Transgraph. The reports and information whether they are emailed to us daily or sourced via your website portal, are a consistent and reliable source of quality information. Our industry is one where information and its dissemination can help in differentiating between suppliers."

- Scott Yarwood, Sr. Regional Sales Manager, ADM Trading (UK) Ltd.

“ This is to state our appreciation for Transgraph for continuously delivering on its mandate to provide updated and insightful consulting services in the area of commodities and ingredients. I would also like to thank your team that is always in touch with buyers and feeds in relevant information that has been many times useful in decision making. In nutshell, the engagement with Transgraph has been enriching."

- V. Sridhar, Sector Manager, Commodities & Ingredients, Cadbury India Ltd.

“ By helping simulate the risk scenarios beforehand, TransRisk has added immense value to our trading decision making process at the operating level. The scenarios are comprehensive because one is able to view the basis and rollover risks associated with the hedged positions too. TransRisk also serves as good Dashboard for the top management, as it gives exposures, P&L, associated risk, limits all at one place.”

- S Sivakumar, CEO, Agri Business, ITC Limited

“ At risk framework and imputed risk model of TransRisk are definitely forward looking

and will enable us to move away from ‘post mortem’ approach. We can

take a business decision of pricing our contracts or purchasing in advance after

factoring in a quantifiable and acceptable risk instead of trying to find reasons

for the breach of limits."

"A flexible and scalable business intelligence that gives exposures, P&L,

associated risk, limits all at one place and this decision support system can be

integrated with our existing ERP and will avoid duplication of data entry.”

- Jude Magima, ED – Sourcing and Supply Chain, Dabur India Limited

“ Transgraph has showcased that ‘Risk Management’ is an excellent tool which will help any sourcing organization to deliver in any and even during challenging business scenario. They have succeeded in creating a deeper, specific and relevant input to the automotive sector. Highly recommended, the course was extremely detailed but the faculty made it so easy to understand - Top marks.”

- S.R. Rajan, Vice President-Commercial, TVS Srichakra Limited.

New Features on Version 3.0

|

1. Inclusion of Exotic Derivatives – TransRisk will be able to receive options and

swaps contracts and will be able to calculate VAR. Complex exotic derivatives, including

Asian Options and Swaps, are also a part of this package.

2. Back testing Report – Users will be able to back test their positions / portfolios or any other randomly selected asset with a configurable VaR methodology. 3. Risk return analysis – This feature displays distributions of various assets for an in-depth analysis of risk v/s returns. Apart from mean and standard deviation, higher moments of probability like skewness and kurtosis can also be analyzed. 4. Technical analysis – Enables users to do their own technical analysis on the price series of any asset. Includes several indicators and oscillators with configurable settings to enable in-depth technical analysis on the fly. 5. Valuation Framework – Multiple instruments may use similar valuation functions, which is optimized in the application with a Valuation Framework. 6. Modular Instrument Framework – In case an organization doesn’t need complex instruments which are a part of TransRisk, they can be turned off for better system performance. 7. Optimized Performance – TransRisk has taken a big leap in performance of VaR Engine. After humongous efforts in load testing and regression testing, TransRisk will now be able to simulate each position and portfolio up to 100000 times, which, for an average portfolio, will need the application to calculate over 300 million numbers with each batch upload. All this is possible with a little additional time taken as compared to current performance. This will be further improvised through parallel processing of dimensions. 8. Other Features – Some other features like setting decay factor, base currency & unit are also being introduced. The normal reports will be replaced with Rad Controls which will offer enhanced UI effect to the users apart from providing them ability reorder columns and sort the results based on some conditions. Multiple currency reporting feature will also be enabled for this new version. |